Introduction

As we look from 2024 towards 2030, the evolution of how we open trading accounts online and open Demat and trading accounts is set to redefine the landscape of the Indian stock market. The shift towards digitalization in the financial sector has already begun to transform trading practices, and this evolution promises to bring about even more significant changes in the coming years. This blog delves into the advancements in online account opening, the impact on the Indian stock market, and what the future might hold.

The Evolution of Online Account Opening

In 2024, the process to open Demat and trading account online has become remarkably streamlined. Financial technology (fintech) innovations have simplified the account opening process, reducing paperwork and improving accessibility. Here’s how the process has evolved and its implications:

- Streamlined Processes: Today, investors can open trading accounts with minimal paperwork, thanks to the use of e-KYC (Know Your Customer) processes and digital signatures. This efficiency has made it easier for individuals to enter the market, contributing to a surge in retail investor participation.

- Enhanced Security: With advancements in cybersecurity, online trading platforms are now equipped with sophisticated security measures. These include biometric authentication and encryption protocols that safeguard investor information and transactions.

- User-Friendly Interfaces: Modern trading platforms offer intuitive interfaces that cater to both beginners and experienced traders. The ease of use has encouraged more people to start investing, democratizing access to the stock market.

The Impact on the Indian Stock Market

The rise in online account openings has had a profound impact on the Indian stock market:

- Increased Market Participation: The accessibility of opening Demat and trading accounts online has led to a significant increase in market participation. More retail investors are now active in the stock market, contributing to higher trading volumes and greater liquidity.

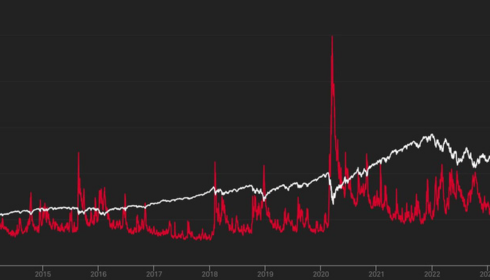

- Greater Market Volatility: While increased participation has its benefits, it also brings challenges. The influx of new investors and rapid trading can lead to increased market volatility. This volatility requires investors to be more cautious and informed about their trading strategies.

- Technological Integration: The integration of advanced technologies, such as artificial intelligence and machine learning, is enhancing trading strategies and market analysis. These technologies are helping investors make more informed decisions and respond to market changes more effectively.

Looking Ahead: 2024 to 2030

As we move towards 2030, several trends are likely to shape the future of online account opening and its influence on the Indian stock market:

- Increased Automation: Automation in trading will become more prevalent, with algorithmic trading and robo-advisors playing a larger role in portfolio management. This trend will further streamline the trading process and improve investment outcomes.

- Enhanced Personalization: Future trading platforms will offer more personalized experiences, using data analytics to tailor recommendations and strategies to individual investor profiles. This customization will help investors optimize their trading strategies and achieve their financial goals.

- Regulatory Developments: Regulatory frameworks will continue to evolve to address the challenges posed by digital trading. Expect more robust regulations to protect investors and ensure market stability as digital trading practices become more sophisticated.

- Global Trends: The evolution of online trading is not limited to India. Global markets are also experiencing similar transformations, and the interaction between domestic and international market trends will influence investment strategies and market dynamics.

Conclusion

Enrich Money provides the best stock trading app for beginners in India, offering a seamless and user-friendly platform to navigate the evolving market trends. By leveraging these tools and staying informed about market developments, investors can confidently embrace the opportunities and challenges that lie ahead.