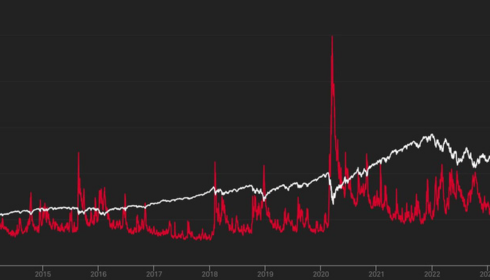

Leverage trading in the cryptocurrency market is a powerful tool that allows traders to amplify their trades, potentially turning small investments into significant profits. By borrowing extra funds, traders can make larger trades, opening up the possibility for greater returns. However, this increased buying power also brings with it an increased risk of larger losses. If the market moves against you, you could end up losing more than your initial investment. That’s why careful planning and risk management are absolutely essential in leverage trading. It’s not just about buying and selling crypto; it’s about making strategic trades that could have a major impact on your financial position. With this greater power comes greater responsibility, making it crucial to stay vigilant and manage risks, particularly in volatile markets. One way to protect your money is by using tools like stop-loss orders, which can help limit your losses if the market turns against you. When exploring leverage trading options, it’s important to understand the specific rules and terms of each platform and to use the available tools wisely. By doing so, you can maximize your potential for profits while minimizing your risks.

Boost profits with leverage, but beware – it also raises the stakes of swift financial losses. This insight comes from BTCC’s Crypto knowledge Q&A, a must-read for those navigating the crypto market.

- How Does Leverage Trading in Crypto Work for Beginners?

- How Does Crypto Leverage Work and What Is It?

- How to Leverage Trade Cryptocurrencies: Ethereum and Bitcoin Examples Explained

- What Are the Key Elements of Leverage Trading?

- What Kinds of Leverage Can You Use in Crypto Trading?

- How to Calculate Crypto Leverage?

- What Is Crypto Margin Trading and How Does It Work?

- Margin Calls: What Are They, and When Does Liquidation Occur?

- Can You Use Leverage in Cryptocurrency Trading?

- Does Cryptocurrency Offer Leverage Options?

- What are the potential losses in leveraged cryptocurrency trading?

- Is Cryptocurrency Margin Trading Allowed in the US?

- Is Margin Trading in Cryptocurrency Risky?

- How Does Bitcoin Leverage Trading Work?

How Does Leverage Trading in Crypto Work for Beginners?

Leverage trading in cryptocurrency is a strategy that turbocharges your trading power, allowing you to enhance your market exposure beyond your initial investment. It’s like borrowing funds to increase your trading position, multiplying your actual investment. However, this comes with higher risks and rewards. Imagine wanting to trade with $1,000 but only having $100. With leverage, it’s possible. In crypto leverage trading, ratios like 2:1, 5:1, or 10:1 express how much your investment can be multiplied. To understand leverage ratios better, here’s a quick reference table.

| Leverage Trading in Crypto For Beginners: | ||

| Leverage Ratio | Your Investment ($) | Total Trading Amount ($) |

| 2:1 | 100 | 200 |

| 5:1 | 100 | 500 |

| 10:1 | 100 | 1000 |

Embark on the journey of leverage trading in the crypto market with caution and strategy. Begin by selecting a trustworthy crypto exchange that offers leverage trading, ensuring your trades are secure. Fund your account with the necessary initial deposit to achieve your desired leverage ratio, paving the way for amplified trades. Decide on the cryptocurrency you wish to trade and determine your position size, balancing risk and reward. However, remember that the crypto market is notoriously volatile, demanding constant vigilance. Margin calls can swiftly occur if the market swings against your position, emphasizing the importance of risk management. Always bear in mind that while leverage trading offers the potential for significant profits, it also carries the risk of losing more than your initial investment. As a newcomer to this exciting yet challenging field, it’s crucial to start with low leverage, allowing you to gain experience while keeping risks manageable.

How Does Crypto Leverage Work and What Is It?

Leverage in crypto trading boosts your buying power, letting you access larger positions than your capital allows. With leverage, small market moves can lead to significant profits, but also increase risk of losses. Understanding how crypto leverage works is key to managing these risks effectively.

How to Leverage Trade Cryptocurrencies: Ethereum and Bitcoin Examples Explained

With limited funds in your account, trading Ethereum (ETH) or Bitcoin (BTC) may seem challenging. However, leverage offers a solution, allowing you to increase your exposure to these cryptocurrencies beyond your actual balance. By borrowing additional funds from a broker or exchange, you can multiply your buying capacity and trade larger positions. For example, with an initial balance of just $250 and 10x leverage, you can trade ETH worth $2,500. Similarly, a $500 investment can be leveraged to trade BTC worth $5,000. Leverage not only enhances your profit potential but also magnifies losses, making it a powerful tool that requires careful management. By understanding how leverage works and using it wisely, you can unlock new opportunities in the exciting world of cryptocurrency trading.

Mitigating risks in leveraged positions demands careful management, essential for investors navigating the crypto and finance markets.

What Are the Key Elements of Leverage Trading?

Leverage trading in the cryptocurrency market is an advanced strategy that boosts your trading power. To effectively manage the risks involved, it’s essential to grasp its key components. Consider the margin this is the initial deposit serving as collateral for borrowed funds. To illustrate, opening a $10,000 position with 10x leverage demands a margin of at least $1,000. Liquidity is another pivotal factor, referring to how easily an asset can be traded without price impact. High liquidity is crucial for swift transactions and price stability during trading. The leverage ratio outlines the extent of borrowed funds used. Common crypto ratios are 2:1, 10:1, or higher, where a 10:1 ratio signifies controlling $10 for every $1 of margin. Lastly, interest rates come into play when borrowing funds for leveraged positions, varying based on the platform and market conditions, often charged hourly or daily.

What Kinds of Leverage Can You Use in Crypto Trading?

In the world of crypto trading, leverage acts as a powerful tool, enabling traders to open larger positions with a smaller capital outlay. Two primary leverage types exist: Cross Leverage and Isolated Leverage, each with its unique characteristics and risk profiles. With Cross Leverage, traders utilize their entire account balance as collateral, maximizing leverage potential based on the total account value. However, this approach carries significant risk, as adverse market movements can expose the entire account to liquidation. Conversely, Isolated Leverage offers a more risk-controlled approach. Here, traders allocate a specific portion of their funds as collateral for a single position, confining both leverage and risk to this designated amount. This method shields the remaining account balance from liquidation threats, providing traders with greater control over the risks inherent in each trade.

How to Calculate Crypto Leverage?

Trading cryptocurrencies with leverage offers the advantage of amplifying your buying power, allowing you to take on more significant positions than your current capital permits. However, to ensure effective risk management and a clear understanding of your potential exposure, mastering the calculation of leverage and margin requirements is crucial. The leverage ratio plays a pivotal role here. To ascertain this ratio, utilize the formula: Leverage = 1/Margin, where the margin is represented as a decimal. For instance, a margin of 5% translates to 0.05 in decimal format. Applying this to the formula yields: Leverage = 1 / 0.05 = 20. This outcome signifies that with a 5% margin, you operate with a leverage ratio of 20:1. In simpler terms, it means for every dollar of your own funds, you have the capability to hold a position equivalent to $20. Furthermore, margin requirements constitute the necessary capital to initiate and sustain a leveraged position, determined by multiplying the overall trade size by the margin percentage.

To open a $10,000 trading position with a 5% margin, you’ll need to meet the margin requirement. This is calculated by multiplying the trade size by the margin percentage: $10,000 x 0.05 equals $500. So, just $500 of your capital is needed to initiate the $10,000 trade. However, keep in mind that this margin amount will be temporarily unavailable for other trades until you close the position.

What Is Crypto Margin Trading and How Does It Work?

Crypto margin trading involves borrowing funds from a trading platform to buy or sell cryptocurrencies. By doing so, traders can increase their market exposure and potentially amplify profits but also losses. The key lies in leverage, which is the ability to control a larger position with a smaller initial investment. To start margin trading, traders must deposit a margin, a fraction of the total trade value, as collateral for the borrowed funds. For instance, opening a $1000 trade position with a 4% margin requirement means committing just $40 from your own funds. Understanding leverage is crucial: Leverage equals one divided by the margin percentage, which is calculated by dividing the margin amount by the position size. In our example, a $40 margin on a $1000 position translates to a 4% margin percentage and 25x leverage. Margin trading thus offers the potential for significant gains but also carries the risk of magnified losses, making it a high-stakes strategy for experienced traders.

Engage in crypto margin trading? Make sure you’re versed in key exchange terms. Know the initial margin, the minimum deposit to open a position. Stay vigilant with the maintenance margin, ensuring your equity never falls below the threshold to keep your position open. Beware, if you fail to meet this, a margin call awaits, demanding more funds or facing liquidation.

Margin Calls: What Are They, and When Does Liquidation Occur?

In crypto leverage trading, margin calls and liquidation mechanics are crucial for risk management. A margin call occurs when your account value dips below the maintenance margin set by the trading platform. If market fluctuations cause your account balance to drop, the exchange alerts you to deposit more funds or assets to sustain your open position. Failure to meet margin requirements can lead to forced position closure. Liquidation happens when a margin call is not addressed, prompting the exchange to shut down the position to recoup borrowed funds. Mastering these concepts is vital for maintaining investment control in this high-risk trading environment.

In the realm of trading, margin calls and liquidation are critical events that every trader must understand. When a trader fails to meet a margin call, the exchange promptly intervenes, initiating a sequence of actions. Primarily, the trading platform moves to close the position, executing an automatic sell or buy order in the opposite direction of the trader’s original trade. This closure generates funds, which are then utilized to repay the borrowed amount along with any incurred fees. To steer clear of this unwanted liquidation scenario, traders should adopt proactive strategies. Chief among these is the consistent monitoring of positions, coupled with a pulse on market trends. Furthermore, traders should periodically assess their margin levels and employ stop-loss orders. By setting a stop-loss, traders can ensure that their position will be closed at a pre-set price, thereby capping potential losses. Additionally, judicious management of leverage is key. Opting for lower leverage levels can significantly reduce risk exposure, as higher leverage requires smaller price movements to trigger a margin call.

Can You Use Leverage in Cryptocurrency Trading?

Leverage in crypto trading lets you trade larger amounts than your capital, amplifying potential profits. This powerful tool is available to all crypto traders, enabling greater market exposure.

Does Cryptocurrency Offer Leverage Options?

Looking to trade digital assets with leverage? Numerous cryptocurrency exchanges provide this option, allowing traders to amplify their positions and potentially increase profits.

What are the potential losses in leveraged cryptocurrency trading?

Leveraging in crypto trading carries significant risks. Depending on the platform’s policies, traders may not only lose their entire investment but also owe extra funds. It’s crucial to understand these risks before engaging in leveraged trades.

Is Cryptocurrency Margin Trading Allowed in the US?

Crypto margin trading is allowed in the US, subject to strict rules set by the Commodity Futures Trading Commission (CFTC). Platforms offering such services must comply with these regulations to ensure legality.

Is Margin Trading in Cryptocurrency Risky?

Margin trading crypto involves significant risks due to market volatility. This can result in either substantial profits or heavy losses, depending on market movements.

How Does Bitcoin Leverage Trading Work?

Boost your Bitcoin trading power! Leverage trading lets you borrow funds, amplifying your position beyond your cash balance. This strategy opens up new opportunities, allowing you to maximize profits with a smaller initial investment.