If you are one among the millions wanting to borrow money from NBFCs, here is some good news to start the new year with a bang. Tata Capital unveils its plans to sanction loans to commercial vehicles apart from already giving digital personal loans within a few minutes. Hence you need not wait a long time to bite your nails whether the loan will get approval. Also, it will help to kickstart your business quickly without losing valuable time to be ahead of your competitors. It also boosts the investors’ confidence by raising the Tata capital share prices in the unlisted market. It is because Tata Capital, being part of the Tata Group, one of the oldest and most trusted business conglomerates, is fast becoming the leader in the non-bank financial sector in India.

Continue reading this blog until the end to know how instant digital commercial loan sanctions favour Tata Capital borrowers and investors through a rise in Tata Capital’s unlisted share price.

How has the Tata Capital myLoan app enabled customers to get personal loans quickly, & easily?

In the last two decades, digitalisation has taken the banking and financial sector by storm, for even their offices are less visited by customers now. This is because most transactions are happening online without needing to stand in long queues in the banks and NBFCs. Tata Capital, one of the top NBFCs in market capitalisation only next to the Bajaj Twins, is one of the pioneers in embracing digital technology. Most of its services, from personal loans to working capital loans and many others, are easy for customers to get online quickly, easily, and safely. As early as 2017, Tata Capital introduced myLoan app to facilitate customers getting personal loans within a few minutes. In 2019, it introduced TiA voice chatbot to facilitate customer service further, and in 2023, generative AI in TiA and ChatGPT with a chatbot to additionally make them more sophisticated to serve customers. It is one of the significant reasons for the Tata Capital share price NSE share price to shoot up rapidly.

How does Tata Capital sanction digital loans for Commercial vehicles in seconds?

Tata Capital, part of the Tata Group, established in 1868 to be worth over 300 billion dollars or around 25 trillion rupees, offers many financial services. It includes microfinance, commercial finance, consumer finance, project finance, infrastructure finance, investment banking, debt syndication, advisory services, credit cards, private equity advisory services, and others. Apart from digitalising personal loans in 2017, Tata Capital 2018 launched an Online Working Capital Platform to offer customers a seamless, paperless, quick, and easy commercial finance line of business up to 2 crore rupees within 24 hours.

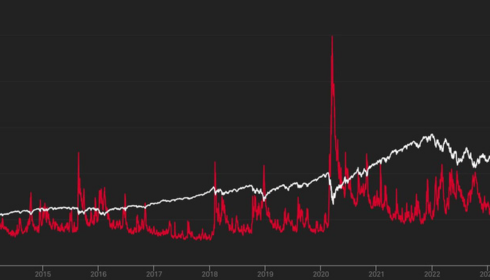

And now, in September 2023, Tata Capital partnered with OEMs or original equipment manufacturers to ensure customers get loans for commercial vehicles within a few minutes. It is because of using Vahan APIs to collect the relevant information of the customers to reduce documentation and time of loan disposal. Such digital efforts for speedy disposal of the loans are increasing its revenue and net profit year after year to raise Tata Capital unlisted share price in recent months.

The facts about the instant digital commercial loan sanction favouring Tata Capital share price in the unlisted market to skyrocket in the last two months of December 2023 and January 2024 from Rs. 500 to Rs. 750.Welcome to Stockify, your portal to alternative investments with lower entry barriers. Empowering retail investors, we offer access to unlisted shares of Blue-chip stocks before their official listing on the Indian stock market (BSE | NSE). Our mission is to assist investors in acquiring unlisted stocks for early investments, potentially reaping multifold returns. Stockify focuses on democratising investment opportunities, allowing individuals to buy unlisted shares and embark on a journey towards financial growth. Discover the potential of early investing with Stockify and gain a strategic advantage in the dynamic world of stock markets.