Technology has made the entire process of investing in and trading financial markets much simpler. Investors can quickly open an account, get verified, and start trading through a single digital platform. Open an Online Demat Account, and you have everything to keep, buy, and sell securities in electronic form without any paperwork. The Online Demat Account for Investors is the modern age account that offers convenience and efficiency in managing assets across stocks, bonds, and mutual funds.

What is a Demat Account?

The demat account or dematerialized account is a repository that exists in the electronic format, which holds financial securities such as shares, mutual funds, ETFs, etc., which are dematerialized into the electronic form. They replace physical certificates and minimize risks of loss, damage, and forgery.

The Demat account works together with a trading account, which enables one to buy and sell securities on stock exchanges. This is the foundation of an investor’s participation in financial markets.

Why go for an online process?

Opening a Demat account would have required massive paperwork and physical verification in earlier times. Now, with those barriers eliminated because of the digital platform, investors can open an account from their smartphone or computer without visiting any office.

When you Open an Online Demat Account, the whole procedure-from registration up to activation-is done without papers and is totally automated. Using electronic Know Your Customer (eKYC) verification, Aadhaar authentication, and digital signatures, the entire setup can be quickly done enabling investors to start trading almost instantly.

Examples of this online process include instant account opening, paperless activation, automatic activation notifications at every new stage, and complete status tracking through the application. Online processes thus save time and even add visibility to the transaction.

Key Steps to Open an Online Demat Account

- Registration: Visit the investment website and register for an account from your mobile number and email ID.

- Document Upload: Identification documents like PAN, Aadhaar, and bank account-related documents must be uploaded.

- Verification: Complete your digital KYC followed by video verification if required.

- E-Signature: Provide an e-sign using the tools meant for digital signing.

- Account Activation: Post-validation, the account will be activated, and you can commence trading with no delay.

This quick process has made it so easy that investors can start constructing their portfolios just minutes after the registration is complete. Investors stand to gain a number of features with an Online Demat Account.

The Online Demat Account for Investors includes access to a wide range of features used to invest and trade:

- Single Dashboard: Hold transactions, views, and valuations all in one place.

- Updates in Real Time: Instant update on stock prices, fund units, and corporate actions.

- Automatic Settlements: Purchased securities would get credited and sold securities would get debited automatically.

- Portfolio Management: Monitor performance and returns, as well as distribution of assets.

- Data Protection: Encryption, biometric access, and two-factor authentication protect data.

These tools simplify account management and allow investors to focus on analysis and decision-making rather than operational tasks.

Immediately Begin Trading

Once the Demat account is up and running, investors can enter into trading using different financial instruments. One can now dabble with stocks, mutual funds, ETFs, and bonds-all available through integrated online platforms.

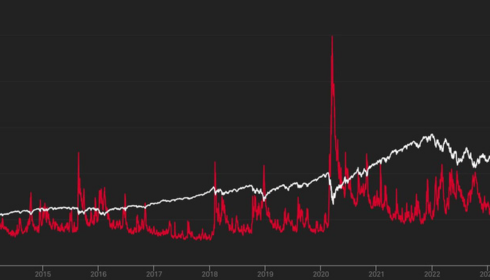

Live market data, charts, and research insight loaded into the trading interface connected to the Demat account allows investors to place buy or sell orders instantly and view confirmations in seconds.

Consequently, every trade reflects automatically in the holdings because both trading and Demat features are incorporated within one system.

An Online Demat Account is far more advantageous India-based investors in the following ways:

- Convenience: Freedom to operate at any time, anywhere.

- Nothing Paper-Related: Cancellations of manual forms and cancellation of physical certificates.

- Speed: Fast terms for set-up and identification.

- Transparency: Online availability of Statements and transaction history at a click.

- Accessibility: Suitable for both beginners and seasoned investors.

That describes India’s investors-they want to be efficient, clear, and in control, and by each measure present them well.

Setting Correct Investment Management Strategy

An Online Demat Account for Investors naturally keeps track of a balanced investment strategy. Investors can monitor their portfolios and assess performance on a regular basis so that they can rebalance their portfolios in keeping with their long-term objectives.

The app-based interface provides all the analysis, alerts, and insights needed to ensure discipline in investments-whether one is actively trading or investing for the future-and thus built a personal pathway towards fulfilling financial objectives.

Conclusion

Opening a Demat Account is even simpler and faster than ever. When you Open an Online Demat Account, it is without paperwork, quick trading access, and a single view of all your investments.

An Online Demat Account for Investors provides convenience, security, and the entire financial instrument visibility across its trade execution. With digital onboarding and real-time activation, investors can begin trading confidently while managing their wealth effectively through one integrated platform.