In the dynamic landscape of startups and investments, boAt’s decision to withdraw its initial public offering (IPO) has stirred discussions and speculation. As one of India’s leading consumer electronics brands, the news has prompted investors to reassess the value of boAt’s share price. Let’s explore the implications of this development.

Understanding boAt’s Journey

Founded in 2016 by Aman Gupta and Sameer Mehta, boAt has swiftly emerged as a frontrunner in the consumer electronics sector. Renowned for its trendy yet affordable audio products like earphones, headphones, and speakers, boAt has garnered a loyal following nationwide. Its success story reflects a blend of innovation, quality, and affordability, positioning boAt as a symbol of excellence in the audio accessories market which is evident in boat shares also.

The Decision to Withdraw the IPO

Withdrawal of an IPO is a significant decision for any company, signalling underlying challenges or uncertainties. For boAt, several factors may have influenced this move:

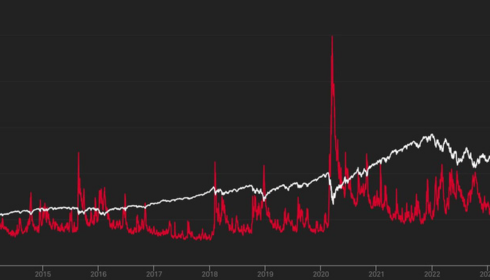

Market Conditions

Fluctuating market conditions, characterised by high volatility or a bearish trend, could have prompted boAt to reconsider its IPO. Concerns about market stability and investor sentiment may have factored into this decision.

Valuation Concerns

Valuation challenges often plague companies planning an IPO. boAt may have encountered scepticism from potential investors regarding its estimated worth, leading to doubts about the IPO’s success. Postponing the offering allows boAt to address these concerns and bolster its valuation.

Regulatory Compliance

IPOs entail rigorous regulatory requirements and disclosures. Non-compliance with these standards can delay or derail the listing process. boAt may have faced hurdles in meeting regulatory obligations, necessitating a withdrawal to ensure full compliance.

Internal Factors

Internal operational challenges or management changes could have contributed to boAt’s decision. Addressing these issues internally before proceeding with the IPO aligns with best practices and ensures a smoother transition to the public markets.

The Future of boAt’s Unlisted Shares

The withdrawal of boAt’s IPO has undoubtedly sparked curiosity among investors, particularly those holding its unlisted shares. While the immediate impact on share prices remains to be seen, investors are advised to closely monitor developments and assess the company’s strategy moving forward.

boAt’s decision to withdraw its IPO underscores the complexities and uncertainties inherent in the IPO process. As boAt navigates this transition, investors must remain vigilant and informed to make well-informed decisions regarding their investments in boAt’s share price, India.Stockify is your go-to destination for financial empowerment, offering real-time market insights, expert analysis, and personalised investment tools. Whether you’re a seasoned investor or just starting your journey, Stockify provides the resources you need to make informed decisions and achieve your financial goals by investing in pre-Ipo shares. Stay ahead of the curve with Stockify’s comprehensive platform, tailored to your unique needs and preferences. Unlock the potential of your investments and embark on your path to financial success with Stockify today.