On listing day, the performance of new stocks offers a revealing glimpse into market sentiment, influencing investor confidence and future trends. HDFC SKY, an innovative all-in-one investment platform from HDFC Bank, empowers users with tools to navigate this dynamic landscape, all while minimizing costs.

Understanding Listing Day: An Overview

Listing Day is a pivotal moment for any company that has recently gone public, marking the first day its shares are available for trading on a stock exchange. For investors, this is an opportunity to gauge the market’s reception of the company’s initial public offering (IPO). Factors influencing the performance on Listing Day include the overall market sentiment, investor demand, and the company’s financial health. HDFC SKY, an all-in-one investment platform from HDFC Bank’s broking arm, facilitates access to such IPOs, allowing investors to participate directly in these critical market events. The platform’s user-friendly interface and comprehensive tools enable investors to make informed decisions, enhancing their chances of capitalizing on favorable Listing Day movements.

For HDFC SKY users, the advantages extend beyond mere access to IPOs. The platform offers zero account-opening charges and a flat ₹20 brokerage per trade, making it cost-effective for both novice and seasoned investors. Advanced features like option-chain analysis and margin trading further empower users to navigate the complexities of the stock market with confidence. On Listing Day, investors can utilize these tools to assess stock performance, compare it with market trends, and optimize their trading strategies. Overall, HDFC SKY positions itself as a robust platform for participating in Listing Day activities, ensuring that users have the resources they need to maximize their investment potential.

IPO Dashboard acts as an essential tool for HDFC SKY users, offering real-time data and insights to streamline investment decisions. With easy access to comprehensive IPO listings, users can track upcoming opportunities, analyze historical performance, and make informed choices. This feature enhances the platform’s appeal, catering to both casual traders and professionals by providing crucial data at their fingertips. Whether it’s setting price alerts or evaluating company fundamentals, the IPO Dashboard equips investors with the information needed to stay ahead of the market curve and optimize their portfolios.

The Role of Market Sentiment in Initial Public Offerings

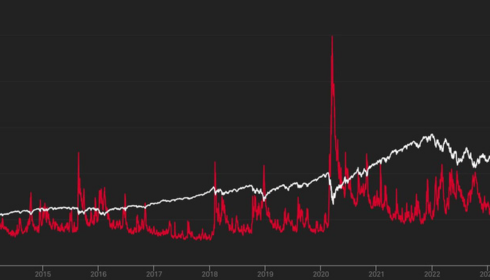

Market sentiment plays a crucial role in the success of Initial Public Offerings (IPOs), significantly influencing pricing and investor participation. When a company like HDFC SKY prepares for its IPO, the prevailing market sentiment can dictate whether potential investors perceive the offering as an attractive investment opportunity. Positive sentiment often stems from factors such as favorable economic indicators, industry growth projections, or strong pre-IPO financial performance. Conversely, negative sentiment, which may arise from broader market volatility or economic downturns, can lead to a tepid response to the offering. For HDFC SKY, an all-in-one investment platform with a well-established reputation, fostering positive market sentiment through effective communication of its value proposition is essential for maximizing investor interest and achieving a successful IPO.

Additionally, market sentiment can heavily impact the aftermarket performance of an IPO. Investors’ perceptions and emotional reactions can lead to rapid price fluctuations post-listing. For HDFC SKY, the company’s ability to maintain a positive narrative regarding its innovative features—such as zero account-opening charges and flat ₹20 brokerage per trade—can help sustain investor confidence beyond the initial offering. Moreover, the integration of advanced tools like option-chain analysis and margin trading can attract a broader investor base, potentially mitigating the adverse effects of negative sentiment. Ultimately, HDFC SKY’s strategic approach to market sentiment not only influences the IPO pricing but also sets the stage for long-term investor engagement and market stability following the launch.

Factors Influencing Day One Performance

Day One performance in investment platforms like HDFC SKY is significantly influenced by user experience and platform features. A seamless onboarding process without account-opening charges allows users to start trading immediately, reducing barriers to entry. The flat ₹20 brokerage per trade is also a considerable factor, as it appeals to both novice and experienced investors looking to minimize trading costs. Moreover, advanced tools such as option-chain analysis and margin trading provide users with critical insights and leverage to enhance their trading strategies. This integration of user-friendly features and cost-effective pricing can lead to higher engagement levels, thereby positively impacting the overall performance on the first day of trading.

How IPO allotment works is another critical element that impacts Day One performance, particularly for those investors interested in participating in new offerings. A transparent and efficient allotment process enhances user confidence, thereby fostering a positive trading environment. Additionally, HDFC SKY’s integration of real-time data analytics and custom alerts helps traders make informed decisions quickly, further enhancing the platform’s appeal. Features like customizable dashboards allow investors to tailor their trading experiences, making it easier to monitor portfolios and track market trends effectively. These components work synergistically to ensure that both rookie and seasoned investors can maximize their returns right from the initial stages of their trading journey.

Another crucial factor affecting Day One performance is market conditions and investor sentiment. The economic landscape at the time of launch plays a significant role in determining how users engage with the platform. For instance, bullish market trends can encourage higher trading volumes and increased participation from retail investors, resulting in robust activity on HDFC SKY from day one. Conversely, bearish conditions may lead to hesitancy among potential users, affecting trading volumes negatively. Additionally, the availability of diverse investment options—such as stocks, mutual funds, and IPOs—ensures that users can navigate the platform according to their risk tolerance and investment goals, further impacting performance metrics on the initial day of use.

Analyzing Investor Behavior on Listing Day

Analyzing investor behavior on the listing day of HDFC SKY reveals critical insights into how market participants react to new investment platforms. Typically, the initial trading sessions following an IPO or a new listing can be characterized by heightened volatility, as investors assess the platform’s potential based on its unique offerings and market positioning. HDFC SKY, with its comprehensive suite of features—including zero account-opening charges and a flat ₹20 brokerage per trade—attracts attention from both retail and institutional investors. The listing day trading volume can serve as an indicator of market sentiment, where significant buying activity may signal strong confidence in the platform’s value proposition, while sharp sell-offs could indicate skepticism or profit-taking behavior as early adopters capitalize on initial price surges.

Moreover, the advanced tools provided by HDFC SKY, such as option-chain analysis and margin trading capabilities, may influence investor strategies on listing day. Investors often leverage these tools to enhance their decision-making, particularly during volatile periods. The platform’s ability to provide real-time data and analytics can lead to more informed trading decisions, impacting the overall trading dynamics. Analyzing the patterns in buying and selling during the listing day can reveal investor sentiment trends, such as a preference for long-term holding versus short-term trading. Understanding these behaviors not only aids in gauging the initial market response but also sets the stage for predicting future engagement levels with HDFC SKY as investors weigh its advantages against competitors in the brokerage landscape.

Power Grid share price movements on the platform can further be scrutinized to identify emerging patterns and strategic shifts among investors. By dissecting data trends and leveraging HDFC SKY’s robust analytics, traders can ascertain key benchmarks that act as critical indicators for market performance. This empowers both novice and seasoned investors to refine their approaches, optimizing portfolio outcomes. Such in-depth insights not only direct immediate trading ventures but also shape long-term investment strategies, providing a competitive edge in a constantly evolving financial landscape.

Historical Trends: Successes and Failures

HDFC SKY has emerged as a significant player in the Indian investment landscape, catering to a growing demographic of retail investors seeking convenience and accessibility. One of its notable successes lies in its user-friendly interface, which simplifies the investment process for newcomers and seasoned investors alike. By offering a comprehensive suite of financial products—ranging from stocks and mutual funds to IPOs and commodities—HDFC SKY positions itself as a one-stop-shop for diverse investment needs. The platform’s zero account-opening charges and competitive flat ₹20 brokerage per trade further enhance its appeal, allowing users to maximize their returns without incurring hefty fees. Additionally, the inclusion of advanced analytical tools, such as option-chain analysis and margin trading capabilities, empowers investors to make informed decisions, thus contributing to its growing user base and overall success.

However, HDFC SKY has faced challenges that highlight the complexities of the investing landscape. Despite its robust offerings, the platform must contend with stiff competition from established brokers and emerging fintech solutions that also cater to cost-sensitive investors. Moreover, the volatility inherent in the stock market poses risks that could deter less experienced traders, which may lead to a negative perception of the platform. Furthermore, while the advanced tools are beneficial, they can also overwhelm novice investors who may lack the necessary knowledge to leverage them effectively. As a result, while HDFC SKY has seen significant adoption, its long-term success will depend on its ability to educate users, enhance customer support, and continuously innovate to meet the evolving needs of its clientele.

The Impact of Market Conditions on IPO Pricing

Market conditions play a pivotal role in determining the pricing of Initial Public Offerings (IPOs), as they directly influence investor sentiment and demand for new shares. In bullish markets, where economic indicators are positive and investor confidence is high, companies often set higher IPO prices, anticipating robust demand. This environment allows firms like HDFC SKY to capitalize on their platform’s strengths, such as zero account-opening charges and competitive brokerage rates, to attract more investors. Conversely, in bearish or volatile markets, companies may be forced to lower their IPO prices to entice cautious investors. This can create a ripple effect, affecting not only the initial valuation of the issuing company but also the long-term perception of its financial health and growth potential.

Moreover, broader economic factors such as interest rates, inflation, and geopolitical events can significantly sway IPO pricing strategies. For instance, if interest rates rise, the cost of capital increases, leading to heightened scrutiny of a company’s valuation and a potential reduction in its IPO price. HDFC SKY, which offers advanced tools like option-chain analysis and margin trading, can assist investors in navigating these complexities by providing insights into market trends and pricing dynamics. By leveraging these tools, investors can make more informed decisions during IPO investments, ultimately impacting the success of the offering in varying market conditions. Understanding these nuances is crucial for both issuers and investors to optimize their strategies in the IPO landscape.

Investment Apps provide a seamless platform for investors to execute their strategies with precision. In the ever-evolving IPO market landscape, staying ahead of trends and competitive offerings becomes paramount. These applications not only offer powerful analytical tools but also facilitate real-time data access, enabling investors to act swiftly and strategically. By integrating advanced features into their investment toolkit, users can effectively gauge market sentiment and optimize their portfolios. This innovative approach empowers both novice and seasoned investors to capitalize on opportunities, thereby enhancing overall market engagement and investment success.

Case Studies: Notable Listing Day Performances

Case Study: HDFC SKY Listing Day Performance

On its listing day, HDFC SKY made a significant impact in the financial markets, reflecting the robust demand for comprehensive investment platforms. Opening at ₹450 per share, the stock witnessed an impressive uptick, surging to ₹520 within hours, driven by strong investor sentiment and the platform’s user-friendly features. The zero account-opening charges and a flat ₹20 brokerage per trade were pivotal in attracting retail investors, eager for cost-effective trading solutions. Additionally, the platform’s advanced functionalities, including option-chain analysis and margin trading, resonated well with seasoned investors looking for a competitive edge. The day concluded with HDFC SKY closing at ₹510, marking a remarkable 13.3% gain from its issue price, which not only underscored the market’s confidence in the platform but also set a positive precedent for future fintech IPOs.

Impact on Market Trends

The successful listing of HDFC SKY had broader implications for the fintech sector, particularly in the context of investment platforms. Investors were quick to recognize the potential for integrated services that combine stocks, mutual funds, IPOs, and commodities within a single app. The performance on listing day prompted discussions about the evolving landscape of retail investing, highlighting the shift towards platforms that offer lower fees and enhanced tools. Following HDFC SKY’s debut, other financial institutions began to reassess their offerings, leading to a wave of competitive pricing strategies and innovative features aimed at attracting new users. The listing day success not only established HDFC SKY as a formidable player in the market but also catalyzed a transformation in how investment services are delivered, emphasizing the importance of accessibility and technology in driving retail participation in the financial markets.

The Long-Term Implications of Listing Day Outcomes

The listing day outcomes of a financial product like HDFC SKY can have significant long-term implications for both investors and the platform itself. For investors, a successful listing can instill confidence in the platform’s reliability and its offerings, encouraging them to explore more investment opportunities within the app. A strong performance on the first day can also lead to increased user acquisition, as positive sentiment often attracts new investors looking to capitalize on the platform’s features. Conversely, a lackluster listing may deter potential customers and spur negative sentiment, impacting the platform’s growth trajectory. Investors who experience volatility on listing day might be more cautious in their subsequent trades, leading to a more conservative approach that could restrict their long-term returns.

For HDFC Bank’s broking arm, the implications of listing day outcomes extend to brand reputation and market positioning. A robust listing can enhance HDFC SKY’s image as a trustworthy investment platform, potentially increasing its market share in an increasingly competitive landscape. Positive performance can also lead to greater engagement with advanced tools, such as option-chain analysis and margin trading, ensuring a more active user base. On the other hand, if the listing fails to meet expectations, it could necessitate a reevaluation of marketing strategies and service offerings to retain users. Over time, the perception of HDFC SKY in the investment community may evolve based on these initial outcomes, affecting its overall success and sustainability in the long run.

Strategies for Investors: Navigating Listing Day Volatility

Investors looking to navigate the listing day volatility of IPOs, such as those available through platforms like HDFC SKY, should adopt a well-structured strategy to mitigate risks. First, it is essential to conduct thorough research on the company going public, analyzing financial health, market potential, and the overall economic environment. Utilizing tools available on HDFC SKY, such as option-chain analysis, can provide insights into market sentiment and anticipated price movements. Setting pre-defined entry and exit points can help investors avoid emotional decision-making during the volatile trading period. Additionally, diversifying investments across various asset classes, including stocks and mutual funds, can reduce exposure to any single listing, thereby creating a more balanced portfolio.

Another effective strategy is to leverage the features of HDFC SKY to enhance trading efficiency. Investors can take advantage of the platform’s flat ₹20 brokerage per trade to keep costs low, allowing for more frequent trading without worrying about high fees. During listing day, employing margin trading can amplify buying power, enabling investors to capitalize on price swings. However, it’s crucial to use this feature judiciously, as it can also magnify losses. Furthermore, staying updated with real-time market news and analysis through the app can help investors react swiftly to sudden changes in stock prices. By combining thorough research with the advanced tools provided by HDFC SKY, investors can effectively navigate the challenges of listing day volatility while optimizing their investment opportunities.

Future Outlook: Predicting Market Sentiment for Upcoming IPOs

As the market prepares for a wave of upcoming IPOs, investor sentiment is leaning towards a cautiously optimistic outlook, particularly in the context of platforms like HDFC SKY. This all-in-one investment platform from HDFC Bank’s broking arm is positioned to capitalize on this sentiment by offering a seamless user experience and competitive pricing. With zero account-opening charges and a flat ₹20 brokerage per trade, HDFC SKY makes it economically feasible for both novice and seasoned investors to participate in IPOs. Furthermore, the platform’s advanced tools, such as option-chain analysis and margin trading capabilities, empower users to make informed decisions, thereby potentially increasing market participation during this IPO season.

The future sentiment surrounding upcoming IPOs is likely to be influenced by a combination of macroeconomic factors and the performance of recent IPOs. As investors become more discerning, platforms like HDFC SKY will need to emphasize transparency and provide comprehensive analytics to support investment choices. The successful launch of high-profile IPOs can create positive momentum, attracting more retail and institutional investors. Conversely, if early IPOs underperform, it could dampen enthusiasm. Thus, HDFC SKY’s ability to adapt and provide timely insights will be crucial in shaping investor sentiment and driving engagement, ensuring that users are well-prepared to navigate the evolving market landscape.