Swiggy has been under the news; US-based asset management company Investco upgraded its valuation to $7.8 billion. It turns down the overall image of Swiggy, even though it failed to surpass its last peak valuation of $10.7 billion at the end of last year.

Adding to the latest valuation by Investco, another investor, Baron Capital, made an investment under Swiggy in August 2023, marking up the company valuation to $8.54 billion. Let’s throw some light on how these valuations impact Swiggy growth.

Possible Growth Plan of Swiggy

The recent increase in Swiggy’s valuation will provide an edge to the company’s growth & profitability. In the past few months, Swiggy reportedly came to the news to connect with investment banks for its IPO valuation, which might launch in 2024. As per the annual reports, Swiggy booked a loss in the last financial year, 2022-23, from $300 million to $545 million, and these losses continue to grow due to tough competitors in the market.

Swiggy emphasised retaining active users and recently scaled up the platform fee by 50 per cent at Rs. 3 per order. The company is constantly trying to overcome its downfall by scaling its operations. Porus, an investor of Swiggy, shared that the company is actively working on leveraging user conversion rates along with the

monthly frequency of orders.

Improved valuation will increase the chance of achieving financial stability The company can use the new investment via IPO to improve its visibility in the market & which might also impact on Swiggy’s Share price.

Reason Why Valuation Might Improves Swiggy’s Position In the Market

Swiggy is fighting for the best to stand ahead in the market. Moreover, it takes active cost-cutting measures, disposing of non-viable business verticals and accelerating operations to gain more profitability. The company aims to debut on the stock market soon. Altogether, the raised valuation will impact the company’s overall budget, allowing it to allocate more funds towards scaling and lead to the IPO by 2024.

Impact On Unlisted Share Market

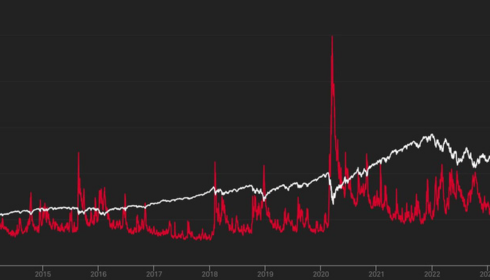

Swiggy’s Share price is currently booked at INR 348 per share, which was Rs. 300 for FY 2022. Invesco bumped up the valuation after consecutive cut-downs in October 2022; it laid down a falling price movement in the market. However, with the jump-up valuation, there will be a high chance the price will go up. Experts are predicting the upcoming IPO will bring an estimation for Swiggy’s share price NSE.

Will Swiggy Raise More Valuation?

Swiggy is actively building a more sustainable platform with better financial performance; there is a prediction that Swiggy will be able to raise an estimated Rs. 1 crore with an IPO by 2024. For achieving its IPO goal, the market valuation metric holds a significant place along with unlisted share prices. It will be interesting to see how Swiggy makes a comeback with valuations.

So, looking at the valuation game of Swiggy, If you are looking for a reliable platform to invest in unlisted shares and get details on Swiggy Share price, know more about it on Stockify!