The National Stock Exchange commonly referred to as NSE is among the chief components of the financial system in India. As the largest stock market in the country, it provides market businesses and investors equal opportunities to be part of the growth story of India and in equal measure serves as an indicator of the country’s economic performance. It is essential to comprehend the main features of the nse, regardless of your level of experience with stocks. The following five points are crucial to remember while interacting with the National Stock Exchange.

1. Market Structure and Segments

Currently the NSE offers numerous financial services and products for various markets and their segments. Among these are the ETFs, the debt securities, Equities trading and Derivatives. The needs of every section with regard to investments and the risks involved are well addressed. For instance, equities allows the investors to buy and sell firm shares while the derivatives lets them engage in more advanced trading strategies such as futures and options.

2. Regulatory Framework and Compliance

Under the direction of the Securities and Exchange Board of India, the NSE is governed by a strong regulatory framework (SEBI). This regulatory authority upholds the integrity of the market, safeguards investor interests, and guarantees honest and open trading activities. It is essential for investors and market participants to be informed on the several laws and policies that control trading, disclosure obligations, and behavior in the marketplace.

3. Technology and Trading Infrastructure

Technology is the backbone of stock market operations in the current digital era. With its cutting-edge trading technology, the NSE can execute deals quickly and effectively. This technology infrastructure consists of real-time data distribution, sophisticated order matching algorithms, and risk management tools. It is crucial for traders and investors to comprehend the fundamentals of trade execution, accessible order types, and trading terminal functions. Understanding these factors might help you develop trading methods that work better and take advantage of market chances.

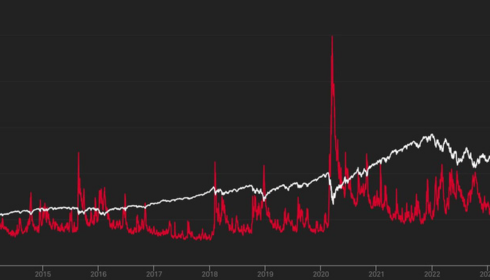

4. Market Indices and Benchmarks

Market indices are important measures of the general health and attitude of the market. The Nifty 50, the premier index of the NSE, is made up of 50 of the biggest as well as most liquid equities that are traded on the market. It is frequently used by investors to assess market movements as well as serves as a benchmark for fund managers. The NSE maintains a number of additional indexes that represent other industries and market niches in addition to the Nifty 50. Comprehending the content, and construction methodology, along with the meaning of these indexes may yield significant insights into market dynamics and facilitate well-informed investing choices.

5. Corporate Actions and Their Impact

Corporate activities are defined as initiatives taken by businesses that have an impact on its stockholders. These can include rights issues, bonuses, stock splits, dividends, mergers, and acquisitions. Trade volumes and stock prices may be significantly impacted by such moves. It is essential for NSE investors to be up to date on business activities. In certain instances, they necessitate prompt action in addition to impacting the value of investments. Investors may efficiently manage their portfolios as well as make well-informed judgments by having a thorough understanding of the workings of various company acts in addition to their potential consequences.

Conclusion

The National Stock Exchange is an essential component of India’s financial markets, constituting a complex as well as dynamic ecosystem. 5paisa Investors alongside market players may traverse the nse stock list more skillfully by taking into account these five important factors: market structure, regulatory environment, technological infrastructure, market indices, and corporate activities. Recall that there are dangers associated in the stock market. As such, you should always conduct extensive research, consult a professional when necessary, and match your investment plans to your risk tolerance and financial objectives.