There’s this moment that creeps up slowly for many entrepreneurs. You’re sipping your morning coffee, glancing over your inbox, and suddenly the thought hits—”Is it time to let go?” That idea of stepping away, of handing over your creation to someone else, isn’t a betrayal of your past—it’s a step into your future.

Selling a business isn’t just a transaction. It’s emotional. It’s personal. It’s strategic. And sometimes, it feels downright overwhelming. But with the right preparation, guidance, and timing, it can also be one of the most rewarding decisions you’ll ever make.

Let’s be honest—most founders aren’t wired to plan their own exit. You’re used to building, growing, solving fires, scaling. You don’t wake up thinking, “Let’s chart out my exit strategy today.” But eventually, the question surfaces, whether it’s due to burnout, a shift in life priorities, or a tantalizing offer that makes you reconsider everything.

That’s where business exit planning becomes more than just jargon. It’s your road map. Done right, it can mean the difference between walking away with pride (and a fair paycheck) or leaving money and legacy on the table. Exit planning isn’t just for those “ready to leave”—it’s for anyone who’s serious about the future value of what they’re building.

Truth be told, the market doesn’t care about your emotional attachment. Buyers want clean books, solid systems, and scalable models. That’s the hard pill many sellers swallow late in the game. They think passion will push the deal across the finish line. It won’t.

This is where knowing your options matters. Not every exit looks the same. You might entertain private equity, strategic acquirers, employee buyouts, or going public. Each path brings its own flavor of complexity. That’s why professionals—whether it’s brokers, investment bankers, or attorneys—exist. Not to take over, but to walk beside you when the stakes are high and clarity is blurry.

One path that often attracts interest—especially for companies with momentum—is the world of mergers and acquisitions. M&A isn’t just for corporate giants. Mid-market firms and even small businesses can find themselves courted by larger players looking to absorb talent, tech, or territory. When structured thoughtfully, a merger or acquisition can unlock growth opportunities for both sides and preserve the brand and people you’ve built.

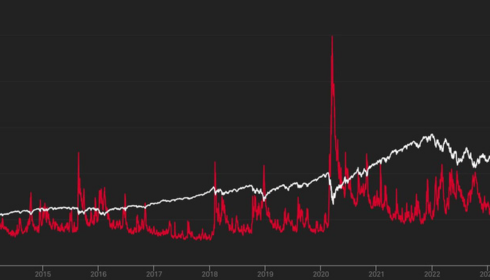

But here’s the kicker most guides won’t tell you—timing the sale is as much about gut as it is numbers.

You’ll see the classic checklists: revenue targets, EBITDA thresholds, industry trends. And sure, those matter. But what also matters is your personal readiness. Are you mentally prepared to not be “the boss” anymore? Have you thought about what you’ll do post-sale? Too many founders realize after the fact that they weren’t emotionally prepared to walk away.

It helps to ask some hard questions:

What am I walking toward, not just walking away from?

Is now the best time to maximize value—or am I running out of steam too fast?

Who do I want to carry this vision forward?

If the answers feel murky, you’re not alone. That’s why early conversations—years before an actual sale—can make a world of difference.

You don’t need a perfect exit. You need a smart one that can sell your company. A sale that reflects the real worth of your business, honors your effort, and positions you (and your team) for a good next chapter.

And let’s be real—some days, the idea of selling feels thrilling. Other days? Terrifying. Both reactions are valid. It’s normal to feel protective over your company. You’ve poured your heart, time, and probably more all-nighters than you care to admit. But growth sometimes means handing over the baton.