Look no further; it is your lucky day to know why Hero Fincorp’s share price tripled within two years. From around Rs. 700 in October 2022, Hero Fincorp’s share price in the unlisted market tripled to its current price of Rs. 2,100 as one of the leading NBFCs in India; Hero Fincorp has grown leaps and bounds in the last decade. The many reasons for this are a hefty loan book in many sectors, rapidly increasing profits, and the expectation of an IPO soon.

In this blog, let us check in detail all the factors that have rapidly raised the Hero Fincorp share price in recent years so you can buy it from the top broker to make unbelievable profits sooner rather than later.

What is Hero Fincorp?

India is a developing country with a lot of potential to be the most populated country and have the highest youth population worldwide. With the globalisation of the economy during the early 90s, India is fast developing to be the fifth largest economy in the world. Hero Honda, a collaboration of Indian and Japanese two-wheeler giants, started manufacturing and selling bikes in India. To help youth buy these bikes, they started financing them in 1991, which was renamed after the separation of Honda aero Fincorp Services in 2011. In the last decade, it became a household financial company that continuously increased its loan products, sanctions, revenue, and profit.

Reasons for the rapid rise of Hero Fincorp’s share price

Hero Fincorp, one of India’s leading NBFC or non-banking financial companies, started giving individual and commercial loans apart from financing buying bikes in 2013. It helped to increase its loan book to provide tough competition to its rivals with lower interest rates and more EMIs. Hence, the revenue or interest earned by Hero Fincorp Services grew in recent years from Rs. 3,877 to Rs. 7,479 crores from 2021 to 2024. Also, the PAT or profit after tax rose many times from only Rs. 51 to Rs. 637 crores for the same period, whereas the NPA or non-performing asset reduced from Rs. 4.61 to 2 crores. The following reasons for the Hero Fincorp share price to triple from October 2022 to current levels of around Rs. 2,100.

- Increasing loan book and revenue for the past few years

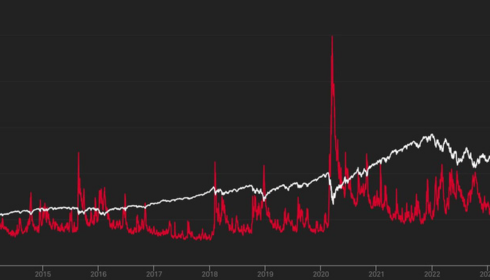

- Favouring market conditions as indexes cut all-time highs many times in recent times

- Reduced NPAs or non-performing assets and increased PAT or profit after tax in the last few years

- Filing DRHP or draft red herring prospectus with SEBI in August 2024 for coming out with an IPO to raise Rs. 900 crores and list in exchanges

Contact the top broker’s consultant now to learn more reasons for the tripling of the Hero Fincorp stock price. Stockify is a cutting-edge platform simplifies stock market trading for novice and experienced investors. It offers real-time data, user-friendly tools, and educational resources to enhance trading strategies. With a focus on transparency and accessibility,stockify unlisted shares empowers users to make informed investment decisions and navigate the stock market confidently.